Will Employee Benefit Brokers Become a Relic of the Past?

When transparency rises, the middleman falls.

Employers are starting to ask uncomfortable questions. Who does my broker work for? Why do my costs keep rising while my coverage keeps shrinking? And in a world where I can buy a car, a house, or a plane ticket directly, why do I still need a middleman to buy healthcare?

These questions are long overdue. History shows that middlemen don’t last forever. When a bridge that once connected buyer and seller becomes unnecessary, it can quickly turn into an obstacle.

When the bridge becomes the barrier

Middlemen didn’t begin as villains. They solved real problems for markets that were fragmented, opaque, or impossible to navigate.

A century ago, Ford couldn’t sell cars in California without a local dealer. The dealer was a vital connection, linking a manufacturer hundreds of miles away to customers who otherwise had no way to reach them. Today, Tesla sells directly to consumers online. Yet in some states, laws still prohibit direct-to-consumer auto sales—a legacy preserved by lobbying and regulation.

Insurance followed the same path. In the early 20th century, someone in Omaha buying life insurance from a company in Connecticut needed a local agent. That agent was the bridge. Today, consumers can compare and purchase insurance online in minutes. The need for a local intermediary has vanished.

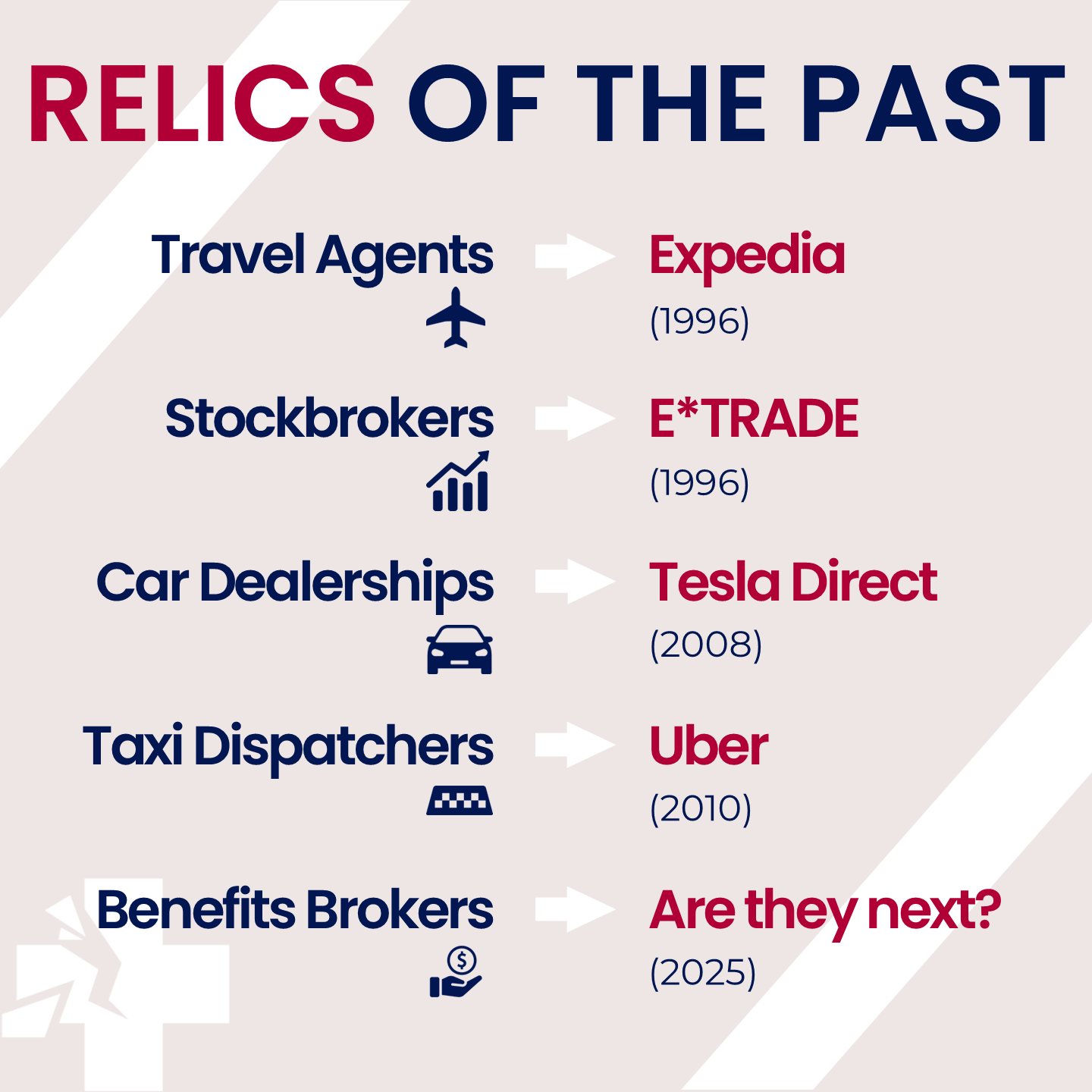

Travel agents gave way to Expedia. Stockbrokers yielded to E-TRADE and other popular direct trading platforms. Taxi dispatchers were replaced by Uber. Each relied on exclusive access to information until technology made that information public.

This story continues to play out across major industries. As transparency rises, the middleman’s grip weakens. That begs the question: are employee benefits brokers next?

The employee benefits conflict nobody wants to discuss out loud

At first glance, a benefits consultant seems to help employers select and manage health plans. That sounds straightforward enough. But scratch the surface, and you’ll find incentives that don’t always line up with the employer’s best interest.

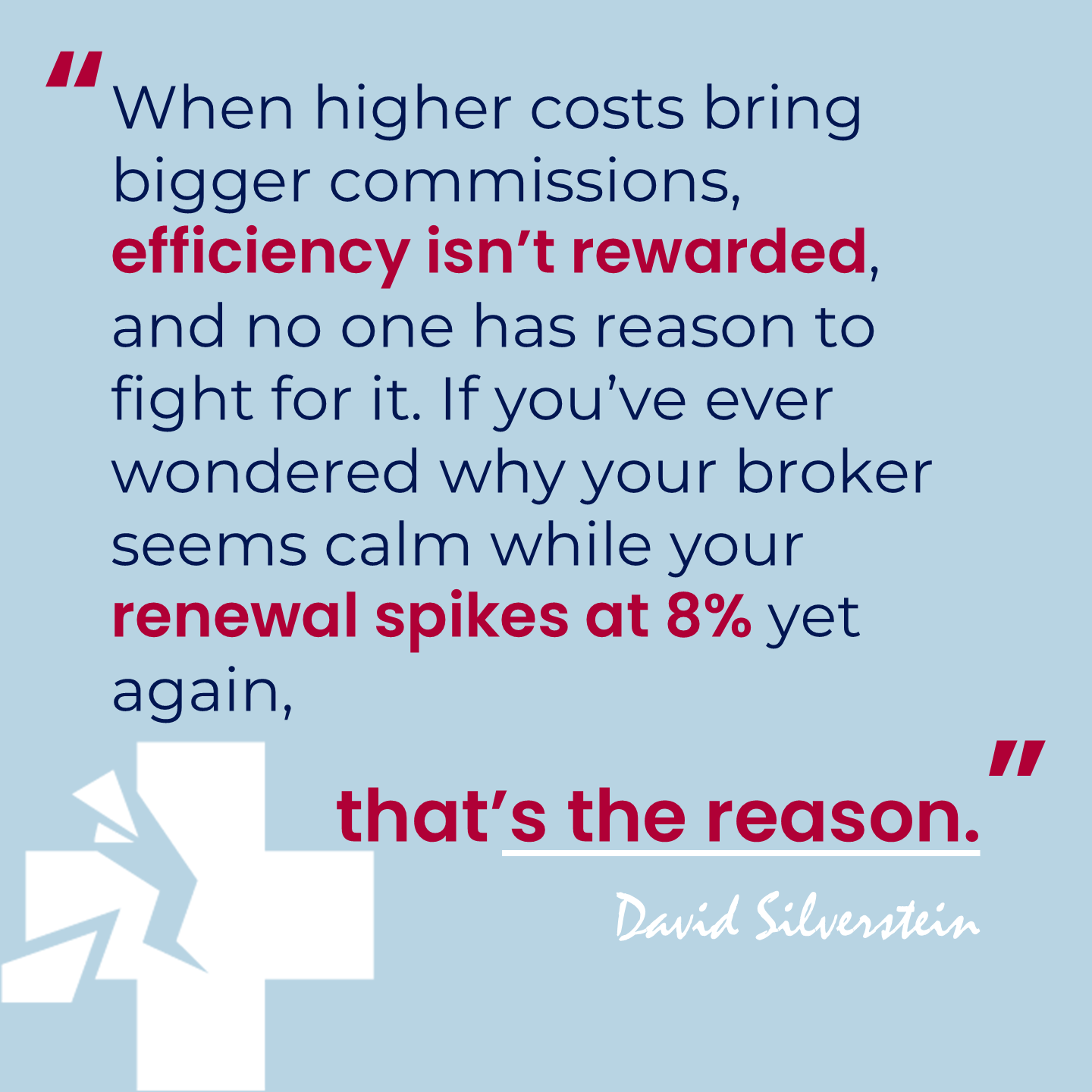

Most brokers are paid by insurance carriers, not by the employers they claim to serve. Their income grows with the size of the premium, creating a powerful conflict: when higher costs bring bigger commissions, efficiency isn’t rewarded, and no one has reason to fight for it. If you’ve ever wondered why your broker seems calm while your renewal spikes 8% yet again, that’s the reason.

The Consolidated Appropriations Act of 2021 requires brokers to disclose all compensation—commissions, bonuses, overrides, carrier payments. In practice, though, most employers I speak with don’t even know if they’ve received these disclosures. And why would a broker volunteer the information if they’re not pressed?

It’s not that brokers are bad people. It’s that the system is built around incentives that reward the wrong outcomes. And when a system rewards the wrong thing, it simply produces more of it—year after year. Employers end up paying more for less.

An industry built to protect itself

No middleman gives up ground quietly. Car dealerships still lobby to block direct auto sales in many states. The health insurance world has its own version. There are rules, relationships, and incentives designed to preserve the old model. Over time, regulation, tradition, and money have built a fortress that protects the system, not the customer.

But fortresses don’t last forever. Protectionism only delays disruption. It never prevents it.

What comes next

Employers have more leverage than they realize. Technology is stripping away the layers brokers have long relied on, exposing inefficiencies that were previously hidden and giving employers tools they never had before. Today, they can:

Analyze their own claims.

Negotiate directly with providers.

Build networks and benefits tailored to your workforce, not your carrier’s priorities.

That doesn’t mean every broker is obsolete. The ones who endure will be those who prove their value through expertise, not through controlling access to information. The rest will go the way of the travel agent.

The questions you need to ask

Start with disclosure. Demand every commission, bonus, override, and carrier payment. The law requires it. If your broker won’t provide it, fire them.

Then consider: what expertise are you paying for that you couldn’t access directly? What would change if costs went down instead of up? How much of your plan is shaped by your needs—and how much by the incentives your broker can’t or won’t reveal?

There’s a future for advisors who choose transparency over commissions and align with employers rather than insurance carriers. The healthcare middleman era isn’t ending tomorrow. But its decline has already begun. Employers are noticing something that has always been true: the system wasn’t made to serve them, and the choice of whether to accept it may soon be theirs.