The Hidden Cost of Family Health: What Employers Overlook in Self-Funded Plans

Ignoring spouses and children is a financial risk.

Who are the most expensive people on your health plan—employees or their family members? If you can’t answer that question, you may be overlooking a major blind spot.

No employer wants to see an employee’s child hospitalized, but it happens. And when it does, the six-figure bill hits your plan just the same, whether it’s the employee or their dependent. Once they exceed their out-of-pocket maximum, the cost is yours.

Dependents often account for a disproportionate share of catastrophic claims. While exact percentages vary by dataset, stop-loss carriers consistently report that 40–60% of their highest-cost claimants are dependents. Sun Life’s analysis of 60,000 stop-loss claims found that newborn and infant care, along with congenital anomalies, are among the top drivers of million-dollar claims. In fact, neonatal and congenital conditions frequently rank among the top 10 highest-cost categories, with individual cases reaching as high as $8 million.

Cancer and chronic conditions among spouses also rank high. Reports from UnitedHealthcare and QBE, another major stop-loss carrier, show that neoplasms (cancers) and circulatory diseases are leading causes of excess-loss claims. These conditions affect both employees and spouses, but spouses tend to skew older, making them more likely to generate high-cost cancer or cardiac claims.

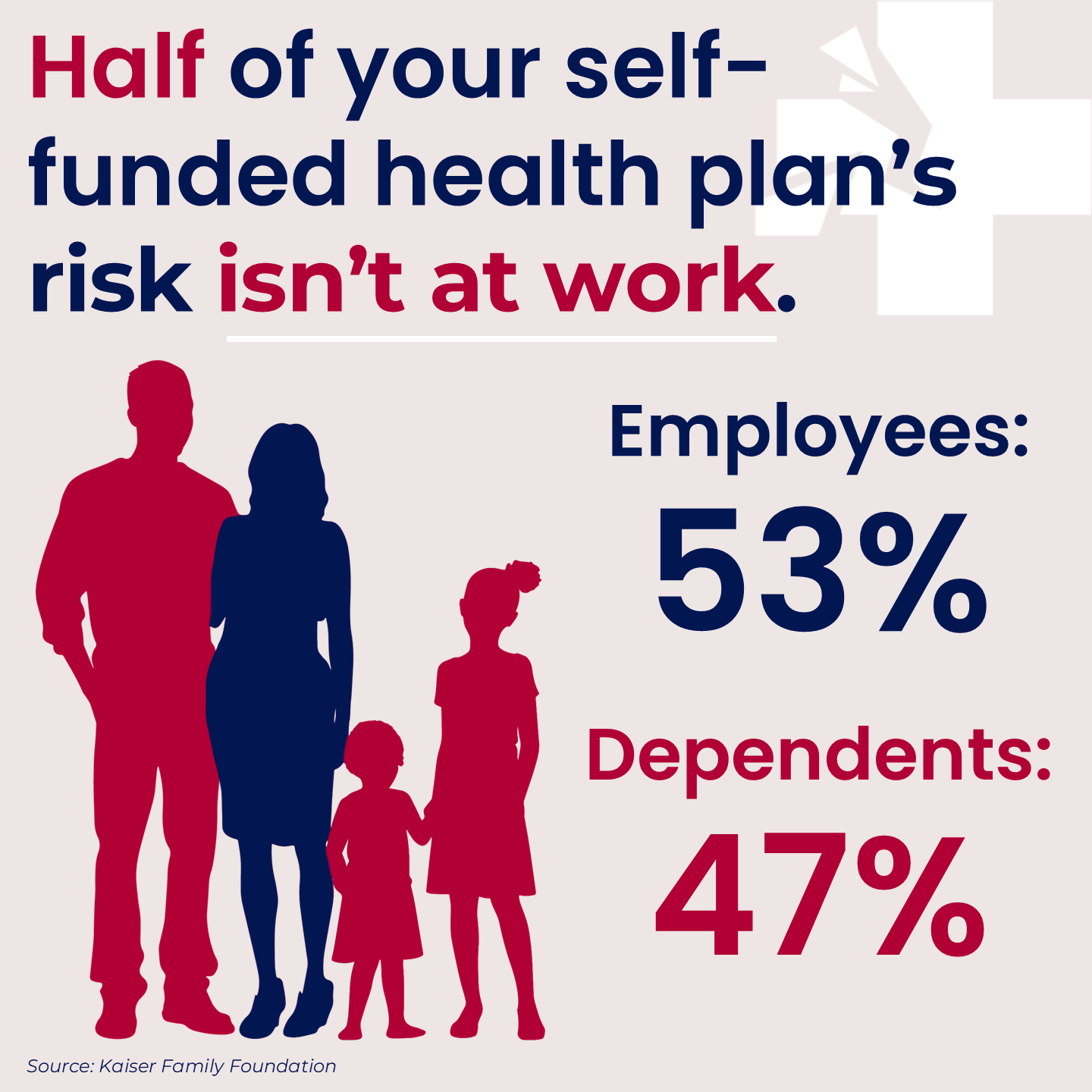

Yet employers invest almost nothing in promoting care for family members. While insurance brokers and benefits consultants have sold employers on gimmicks like biometric screenings, health fairs, and step challenges, I’d wager fewer than one in a hundred companies pay meaningful attention to family health. And yet, the data tells us that’s where half the cost lies.

How self-funded plans really work for families

By law, employers must cover at least 50% of the employee’s health insurance premium. They’re not required to contribute toward spouses’ or dependents’ premiums , so employees often pay the full family premium themselves. Employers have little incentive to cover family premiums, and by not doing so, they implicitly encourage spouses to use their own employer’s plan. That’s not irrational. Covering family members, regardless of who pays the premium, effectively doubles an employer’s claims exposure.

The grand illusion

When I speak to employers, I encounter a pervasive fallacy: because they don’t subsidize family premiums, they assume they’re not spending much on family members. However, premiums are unrelated to claims. Once someone is on the plan, the plan pays—dollar-for-dollar—the same whether it’s the employee, a spouse, or a child.

Meanwhile, most employer health strategies focus almost exclusively on employees. Wellness programs run through company email. Care navigation assumes people work in the building. Disease management operates during business hours. So, who’s managing the spouse’s diabetes? The child’s asthma? Prenatal care for a pregnant nineteen-year-old?

A lack of data, insight, and action

Most HR teams lack visibility into dependent health. Without insight, employers try to control costs without understanding what’s driving them. When a preventable condition spirals into a catastrophic claim, it feels like bad luck. It’s not. It’s bad information.

One unmanaged condition, especially among dependents, can destabilize your entire plan. Stop-loss premiums spike. Plan performance deteriorates. Wellness ROI evaporates. And yet, participation rates may look great, leaving everyone wondering why costs keep climbing.

By focusing only on employees, you’re leaving half your risk and much of your cost unchecked.

Where to start

Managing healthcare as a business expense, not just an HR benefit, starts with asking questions that rarely get asked:

Who are your high-cost claimants—employees or dependents?

What conditions are driving your spend?

Which family members are slipping through the cracks of your wellness and disease management programs?

Once you have the answers, you can act. Extend care navigation to spouses and children. Make sure families with chronic conditions know what resources exist. Use data to anticipate and prevent expensive claims rather than just reacting. That’s how insight translates into savings and better outcomes.

A dollar saved by helping a dependent get timely care is the same as a dollar saved anywhere else. A 14-year-old who winds up in the ER because of poorly managed sports-induced asthma is an avoidable ER visit just like the one that results from a 45-year-old’s unmanaged type II diabetes.

Self-funded plans give employers control over healthcare costs, but control depends on visibility. If you can’t see what’s driving spending, you’re not managing risk; you’re just reacting to it.

The next major claim on your plan probably isn’t coming from someone in your office. It’s likely coming from someone at home.

And that’s worth fixing.